Ontario cities have two ways to raise funds: property taxes and user fees. We pay user fees when we use services like water, swimming lessons, sewage and transit.

Cities do not have enough revenue to cover the cost of all the services they provide so they rely on higher levels of government (provincial and federal) to transfer funds for vital programs and services.

Did you know that Ontario is the only province in Canada that pays for social services with property

taxes? This creates a revenue problem. We can work together to ensure that provincial and federal governments fix the funding formula to make more money available for our cities and make services for people a priority again.

The health of our communities depends upon it.

Where Governments Get Their Money

For every dollar collected in taxes, the Federal government gets 47 cents, the Province of Ontario gets 44 cents, and Ontario cities get only 9 cents.

| FEDERAL (47 cents) | PROVINCIAL (44 cents) | MUNICIPAL (9 cents) |

|

|

|

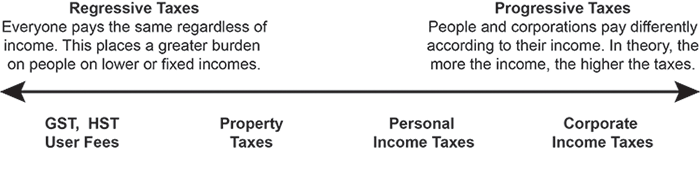

Not All Taxes are the Same

Contributing to Good City Budgets

People around the globe are taking a look at the budgets of city governments and calling for changes that will better meet the needs of their families and communities.

Why Now?

Since the 1990s, responsibilities have been passed down to municipal governments without adequate resources. This mean the City of Ottawa has been paying for services that used to be paid for by the provincial government. Even though the provincial government has been “uploading"(reassuming the costs of some social services), many services continue to be reduced. This is having an impact on people who are marginalized.

For example, women, who still tend to assume more responsibility as family caregivers and community volunteers, may have more unpaid work to do. Their paid work may diminish, because they are more likely to work in the “caring” professions where cuts are most likely to occur. This threatens gains women have made in reducing violence against women and accessing quality child care.

People living in poverty, people with disabilities, Aboriginal people, racialized people, recent immigrants, refugees and travnsgender people are also more likely to feel the impact of budget cuts, because they typically rely more on community services.

The experiences of all these communities and the agencies working with them need to be heard.

Budgets are Not Boring

The budget is not just about dollars and cents. It’s about our quality of life and our communities.

The City of Ottawa budget is a blueprint for how our property tax dollars will be spent. It spells out the priorities for the municipal services and programs that we depend on each and every day.

Planning a City Budget

Think about it. The water we use each morning, the bus we take, the park where we picnic, the

paramedics who respond to an emergency in our neighbourhood, the community house and the community centre. These are all services included in the City of Ottawa budget.

Just Like Home

A city budget is like our budget at home. We have to look at our needs, the amount of income we have and any savings put away, and then decide what we can afford.

How your City Budget works by City of Ottawa

A budget is made up of four parts:

- Operating Budget – This is like your monthly bills such as rent or mortgage, heating, water, electricity, clothing, laundry, food, child care, medicines and car repairs – you name it! For the City, it’s the day-to-day operations, including programs and services such as administration, policing, public health, recycling and recreation.

- Capital Budget – This is like the money you need to pay for buildings, systems and belongings. For us, it’s repairs on your home, replace a car, a broken alarm clock or mend a broken fence. If you buy a home, it’s the down payment on the mortgage. For the City, it includes costs for buildings, vehicles, roads, sewers, bridges, community centres and parks.

- Revenue – This is like the total income earned by everyone at your house. The total of what everyone makes. The City, revenue includes taxes, money from the federal and provincial governments (called ‘transfer payments’) and user fees.

- Reserve Funds – This is like your savings, pension, retirement fund, and/or RRSPs. This is money to fall back on when you need it or for planned future capital costs. For the City, reserve fund is cushion to deal with unexpected expenses and a savings account for planned projects.

Each year, the City goes through a budget process to determine how much it will need to spend on a daily basis (operating budget), how much to repair or purchase on buildings, roads, sewers (capital budget), and how much money it has to set aside for unexpected expenses.